tax strategies for high-income earners 2020

Third you reduce your tax burden because the money goes straight to a charity so it does not appear as income on your tax return. Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners.

What Is Taxable Income And How To Calculate It Forbes Advisor

One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of.

. Use a Health Savings Account HSA Photo by. One of my favorite tax strategies for high income earners is investing in real estate. For instance the 2017 Tax Cuts and.

A donor-advised fund DAF is an investment account created to. There are ways to lower the tax bill of high-earning investors but it often involves the help of a professional who knows the ins and outs of tax laws. Ad Turn to our professional team to manage investment accounts of 500K or more.

You make your contributions with pre-tax dollars as the money is deducted from your payroll. Ad Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does. Creating retirement accounts is one of the great tax reduction strategies for high income earners.

Ad 6 Often Overlooked Tax Breaks You Dont Want to Miss. July 24 2020 225242. Max Out Your Retirement Account.

You Might Be Able to Turn That Tax Bill into a Refund. Tri-Merit Has The Technical Expertise You Need And The Flexibility You Want. Other than the reality you need a comfortable retirement putting resources into particular kinds of retirement accounts is one the best tax strategies for high income earners.

Thats why its one of the most popular tax reduction strategies. Ad Turn to our professional team to manage investment accounts of 500K or more. Ad Contact Us to Develop The Appropriate Wealth Strategy For You.

How to Reduce Taxable Income. Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

If you are a high earner with an income above the IRSs income limit for Roth IRA. If you wish to save tax. Health Savings Account Investing.

Income in excess of 400000 may classify you as a high-income earner and subject you to higher tax rates. 1 Ad Make Tax-Smart Investing Part. Schedule a meeting tell us about yourself and let us recommend a plan for you.

You may want to ask them about some of these investment strategies. Other than the reality you need a comfortable retirement putting resources into particular kinds of retirement accounts is one the best tax strategies for high income earners. The main reason is that youre able to recover the cost of income-producing property through.

When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden. They will use strategies to help you. Schedule a meeting tell us about yourself and let us recommend a plan for you.

By controlling when you realize gains or losses you can move your overall tax rate in the direction that lowers your tax liability. If your work or assets generate. Find The Mariner Wealth Advisors Office In Washington DC.

T he top income tax bracket c ould revert to 396 which was. Once you have the right team of financial professionals who understand your financial situation there are some investment strategies you may consider using this year. But when it comes to tax strategies timing is essential.

Learn More at AARP. A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners.

If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. The law permits you to deduct the amount you deposit into a tax-certified. 6 Tax Strategies for High Net Worth Individuals.

Legislature Seeks Huge Tax And Spending Hikes In Next Ny Budget Empire Center For Public Policy

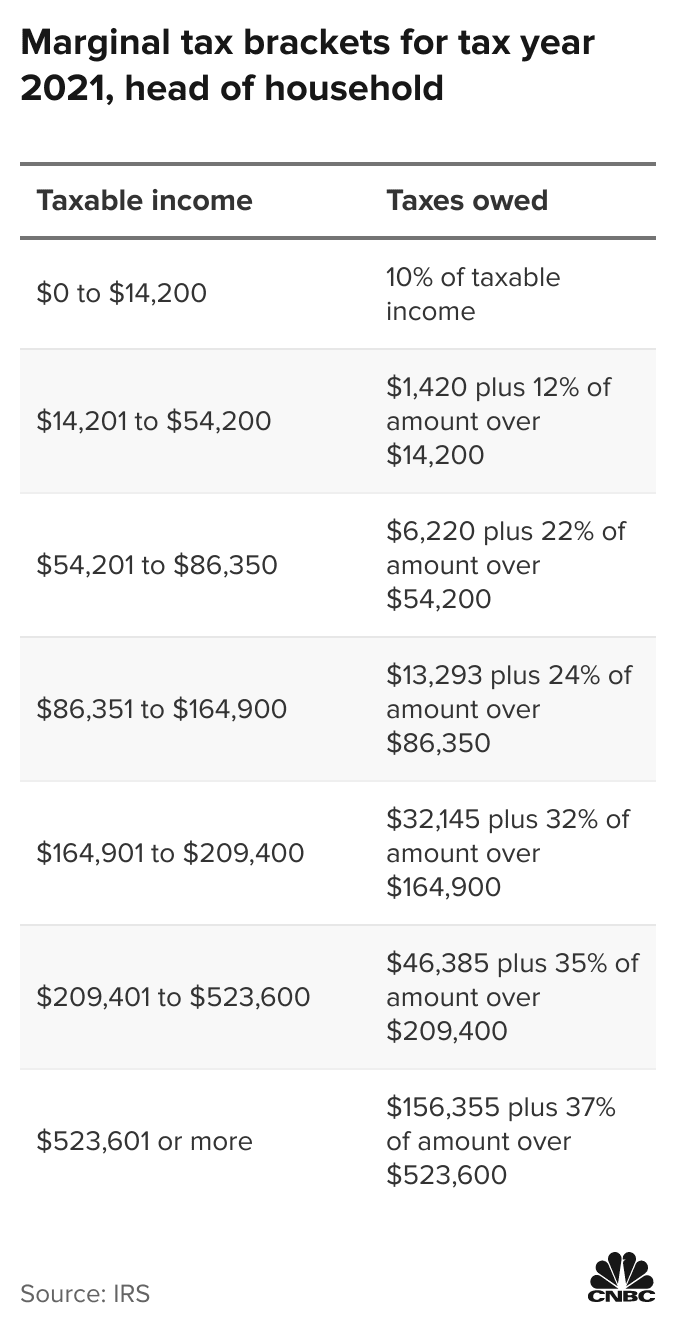

Single Vs Head Of Household How It Affects Your Tax Return

What You Need To Know About 2020 Taxes Advisors Management Group

Single Vs Head Of Household How It Affects Your Tax Return

Pin On The U S Latino Community And Their Health Disparities

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Single Vs Head Of Household How It Affects Your Tax Return

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira

Changing Domicile For Tax Purposes Bny Mellon Wealth Management

Investing In Yourself The Most Valuable Asset You Own Effective Ways Investing Investing For Retirement Finance Investing

Budget 2020 Dividend Distribution Tax Scrapped But Shifts The Burden To The Recipients High Income Earners To Bear Th Dividend Higher Income Dividend Income

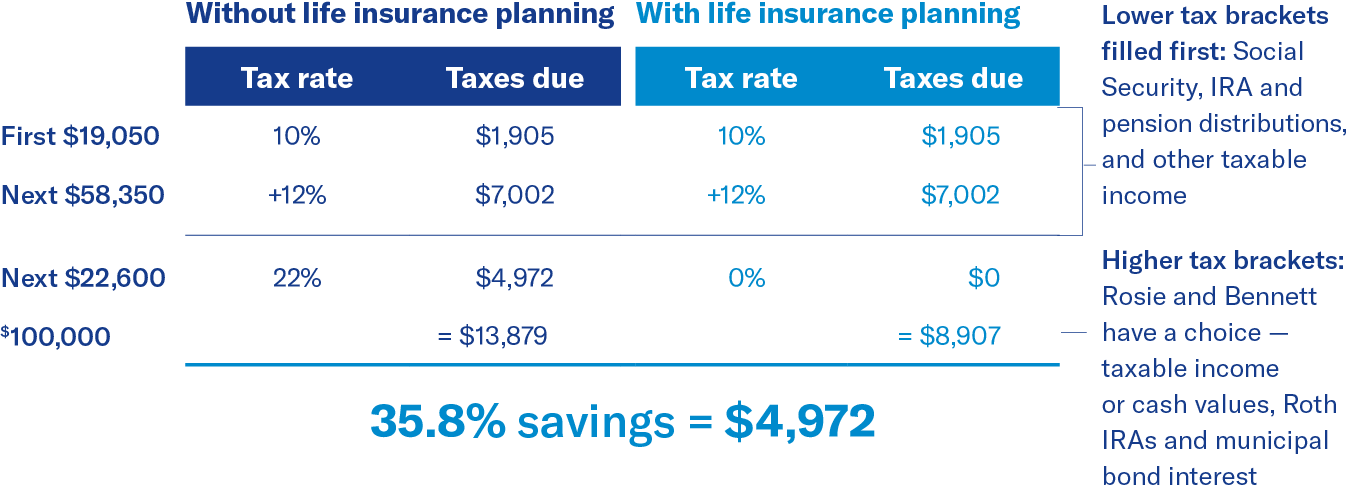

Using Life Insurance To Help Minimize Taxes In Retirement

Last Minute Ways To Reduce Your Taxes For 2022 Gobankingrates

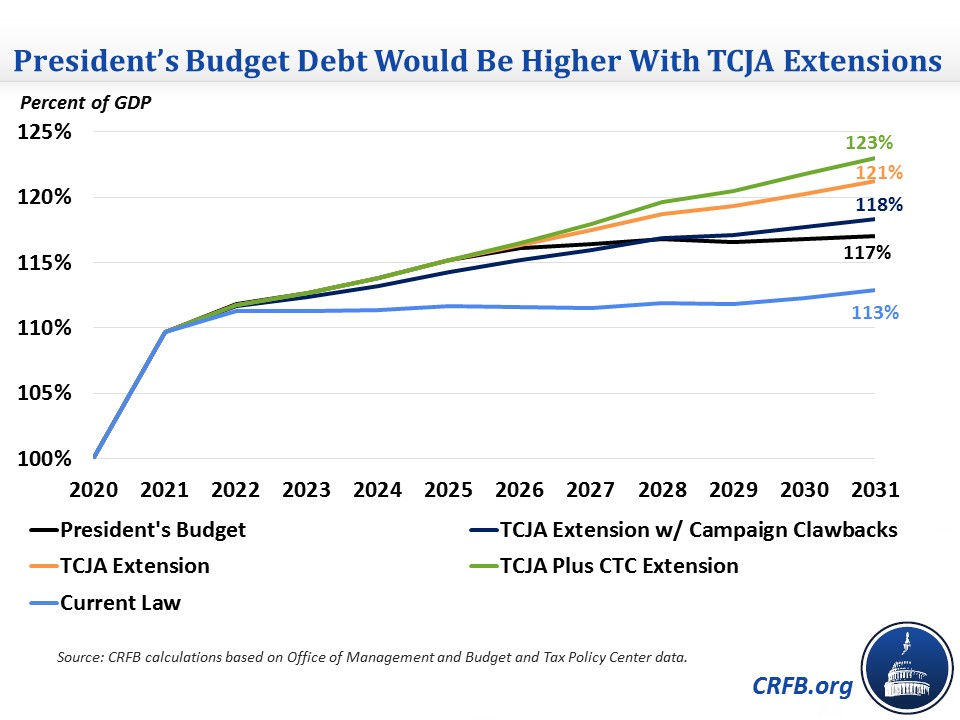

President S Budget Would Add More To Debt With Tax Cut Extensions Committee For A Responsible Federal Budget

Tax Geek Tuesday Making Sense Of The New 20 Qualified Business Income Deduction

Investing In Yourself The Most Valuable Asset You Own Effective Ways Investing Investing For Retirement Finance Investing